|

|

|

Dear

Prospective

Client,

22nd Aug, 2025

Since you are reading this, I assume you came to know about Ujjval Investments,

LLC through of one of our clients or well-wishers. I hope you received an unbiased

opinion about who we are and what I do.

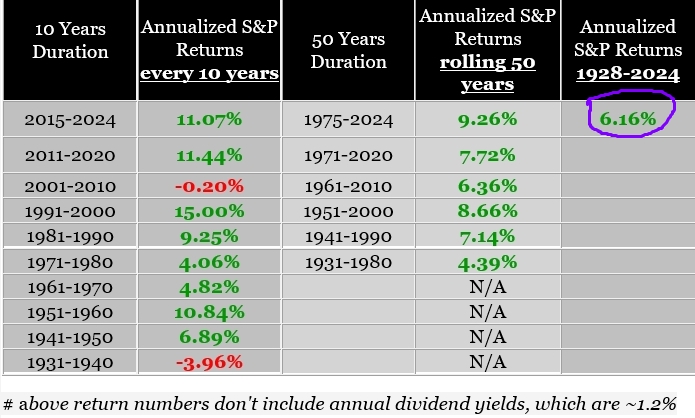

At Ujjval Investments, I have been helping families manage their investment portfolio since the beginning of Y2011. From day one, I designed my service around honesty, integrity and with zero conflict of interest. As a portfolio manager, I serve in fiduciary role (legally required to put client’s interest ahead of my own) but I opted to go much beyond that. I have completely aligned my financial interest with those of my clients and expected only do well if client is doing better. As a result, whenever I invest client’s money in a business, I invest my own money alongside theirs – most of the time in larger dollar amount. Firm began with $300K in assets under management (AUM) in Y2011 and has grown to $10 million AUM today. I wish to think that I am just getting started! In Aug 2025, I have completely redesigned our performance-based fee option and holding myself to higher and tougher standard. You may find that opting for this fee choice would be as compelling as having a Costco membership.

Since the beginning, I have

stayed true to the investment philosophy and values that were shaped and

reinforced during the turbulent times of 2008-09 Financial Crisis. Of course,

my thinking has evolved over time. I have learned what kind of business makes a

better long-term investment, how to isolate business with sustainable

competitive advantage and how mgmt’s corporate level decision can ultimately

make or break long-term value of the company.

We have learnt, sometime hard way, what warning signs to watch for, often years before they might become problem

for the portfolio.

It is challenging and inconceivable to capture the depth of wisdom gained over the last 15-20 years of investment journey and still keep this letter succinct. That is why, I use my Annual Letters to share lessons and investment insights I have developed over the years. You can find past 15 years letters on our website: www.Ujjval.com

In this introductory letter, I would like to highlight the five core pillars that

shape the way I build and manage investment portfolios.

Allow me to illustrate the true power of compounding with a hypothetical scenario involving two investors – Ms. Euphoria and Mr. Rational. Each starts with $200K for investing, and planning to contribute $20K annually to the portfolio. For the sake of simplicity, let’s assume that their effective tax rate on capital gain is 20% and even lower on dividends (with special low tax rates stipulated by IRS). Each investor plans to stay invested for the next 30 years before liquidating the portfolio. Portfolio-1: Ms.

Euphoria is in a hurry to get rich, so she decides to invest in

companies that are growing fast and in vogue. She prefers to dance in and out

of the market every year with the hope of outsmarting the market. She makes an

impressive +30% return during 1st year as well as 2nd year but

incurs -15%, a loss during 3rd year.

Since such investors tend to buy-and-sell their holdings frequently,

let’s assume that a 20% tax applies in the first two years, with no tax on the

loss in the third year. This three-year cycle repeats for the entire 30-year

investment horizon.

Portfolio-2: Mr. Rational is adopting a conservative and defensive strategy. He understands the tradeoff of investing with high-growth but expensively valued companies. He is happy with a 12% annual return while trying to avoid large negative years. His portfolio also earns an annual 2% yield from dividends. He doesn’t see any intelligence in market timing and dancing in and out of the market. He pays annual tax only on the dividends and one-time 20% tax on capital gain at the end of the 30-years period. One would like to think that a portfolio giving a hyper 30% growth rate for two

years would do better despite having one smaller loss in between. I have

computed the year-end numbers for each of these two portfolios in the following

Excel sheet. If you look carefully, as years progress, the compounded value in

the portfolio will start diverging, and the spread widens more as the

investment horizon gets longer. After the 10th year-end, Ms. Euphoria has $863K, while Mr. Rational is at $1.12 M. However, true

magic unfolds in the subsequent years. By the 30th year-end, after

capital tax payment, Ms.

Euphoria is sitting at a $5.47 million portfolio, whereas Mr. Rational stands

at a $13.59 million portfolio, almost 2.5x larger.

The

much higher returns for Mr. Rationale are attributed to him meeting the

essential requirement of the Compounding Magic --avoiding large negative return years. We frequently come across high flier stocks with high growth rate. Many of them

are wonderful businesses but valuation reaches at such extreme that during

market reversal or correction they lose significantly. I really like to avoid

investing in business where few years of appreciation quickly wiped out during

such downturns. If really like to have high thrill roller coaster ride, I would

rather visit Six Flags! When comes to our portfolio, my preference remains to

invest in steady-eddy business that gives us decent but sustainable avg annual

return as what we have observed with Mr. Rationale. Temperament Overweight Talent

With investment grounded in through

research and solid fundamentals, I can be aggressive buyer during such

bargain-hunting opportunity. I have demonstrated this during the Financial

Crisis of 2008-09. Some of my best performing and largest investments were made

during these periods of panic and continue to deliver handsome compounded

returns over the years. Focus on Economic Profit With

mature companies, growth usually follows a steady and predictable path.

High-growth firms, on the other hand, present a very different challenge: their

future performance is far less certain, and prices often reflect excessive

optimism. When a business shows signs of accelerating revenue or earnings—say,

over the next 1–3 years—the market quickly becomes optimistic. Optimism can

turn into enthusiasm, and enthusiasm into speculation. Investors begin

projecting today’s growth far into the future, assigning ever-higher valuations

and paying steep premiums. In these cases, the current earnings yield is almost

negligible, and the investment thesis rests almost entirely on expectations of

future growth. Eventually, prices reflect not just how the business may

perform, but also how much the next investor might be willing to pay. At that

stage, speculation has replaced pragmatic analysis, and the risk of

disappointment is high. That is

why valuation discipline sits at the core of our investment philosophy. Our

role is not only to allocate your portfolio wisely but also to ensure each

investment decision is grounded in a price that offers both protection and

potential. We fully agree that exceptional businesses with durable competitive

advantages and strong growth prospects deserve a premium valuation—but such

businesses are rare. Paying the reasonable price lays the foundation for

compounding; Paying too much today can turn even the best businesses into

sources of disappointment tomorrow. Enduring Competitive Advantage Coca-Cola is a classic example. For over a century,

it has faced countless competitors—yet its powerful brand, global reach, and

loyal customer base have kept it on top. Even when new drinks came and went,

Coca-Cola’s advantage allowed it to generate Economic Profit and grow steadily. Tesla shows another path. By pioneering the modern electric vehicle

market, it created an entirely new space where traditional automakers were slow

to adapt. Its first-mover advantage, combined with its charging network and

strong brand, gave it a very powerful head start. More importantly, Tesla

continues to widen this edge by Elon Musk focusing on self-driving technology

and advanced software—features that most competitors are still struggling to

match. These innovations make Tesla not just a car company, but a technology

leader with a moat that it kept expanding over time. Apple, meanwhile, built its strength by expanding what many call a

“walled garden.” Its products and services connect seamlessly—once a customer

buys an iPhone, they often stay with Apple for apps, music, watches, and

computers. This loyalty not only protects Apple’s market position but also

allows it to steadily expand its profit margins. For me,

the message is clear: businesses with durable advantages—whether through

timeless brands, pioneering new markets, or deepening customer loyalty—offer

the best chance for steady growth and the kind of compounding that works in our

favor over decades. Of course, such wonderful businesses are rare and often

come with high valuations. Our real advantage lies in recognizing these

businesses early, or waiting for those rare moments when valuations drop,

giving us the opportunity to participate in their growth and enjoy the

compounded rewards over the long term. Fees and Compensation

I offer two different fee choices for

providing portfolio management and allocation service to you. Irrespective of

which fee option you opt for, the investment allocation will be in a similar

manner. Let

me walk through these two choices,  Using

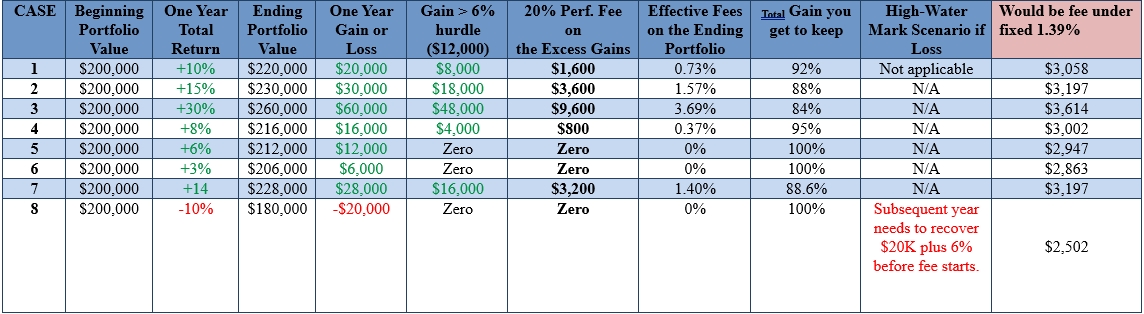

return pattern discussed above, I have designed an incentive system that only

rewards true outperformance. This is a 0-6-20

performance-based fee model, here is how it works: To

help clarify the 0-6-20 performance-based fee structure, here are couple of

hypothetical scenarios. Assume a starting portfolio size of $200K. With a 6%

hurdle rate, portfolio must generate at least $12,000 gain before performance

fee is considered.  Since you may be curious to see how 0-6-20 performance-based fee compares

against 1.39% fixed fee option, I have included flat fee results in the last column in the above table.

As you may observe, during the low return or loss-making year,

performance-based fee comes out very appealing. In general, performance-based

fee better aligns incentives to have win-win arrangement in all circumstances.

I will only do well when you do exceptionally well. With the performance-based

fee option, my compensation only exceeds the flat 1.39% fee if your portfolio

earns more than a 14% return, as you may observe in the 7th case

in table above.

Client can provide us

needed documents to verify this eligibility or use 3rd party service

like VerifyInvestor to get a certificate confirming the eligibility

for $299 cost.

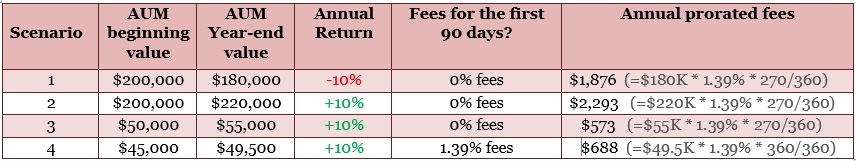

For example, consider the following hypothetical scenario showing how fees would apply under different portfolio sizes, assuming both a 10% gain and 10% loss scenarios.  To qualify for this flat fee option, I require a minimum of $45,000 in the portfolio at the start of our contract. The portfolio could be made of one or more accounts belong to the same household members. If funds are received in the middle of year, fees will be prorated accordingly. Clients are free to deposit (or withdraw) funds at any time. Management fees will be adjusted on a prorated basis whenever new money is added or withdrawn. ----------------

At the end of each calendar year end, I provide clients with annual letter. In the annual letter, our portfolio manager, Ujjval will discuss portfolio performance, broader investment and economic landscape, provide overview behind various investments, outlines our plans going forward, etc. One of the objectives of the letter is for Ujjval to share any investment knowledge and wisdom during the year. I will also provide you annual invoice for our services. Invoice would have details on how much annual return you earned, how much was in dividend income, what was the S&P 500 index’s market-cap weighted and equal-weighted returns for comparison, etc. details. In the invoice, we provide three options to pay our fees: 1) I could have IBKR deduct the fees from the portfolio directly. I prefer not to do that from tax-deferred or tax-free accounts. 2) Client could send the money via Zelle to mgmt@Ujjval.com or 3) Client could send us a check, payable to “Ujjval Investments, LLC”. If what you’ve read resonates with you, I would be happy to setup a 90-minutes conversation where I can learn more about your goals, return expectations, risk preferences and past investment experience. Taking on the responsibility of managing your long-term financial assets is not something I take lightly. I would make sure I can answer all of your questions and will take time to ensure you have a clear understanding of what I can offer. My goal is to make sure this partnership fees right for you. Sincerely, Ujjval D. Portfolio Manager Ujjval Investments, LLC |

| Copyrights © 2011-2026 Ujjval Investments, LLC. All rights reserved. | Home | Privacy Policy | LLC Certificate | Contact |